- The ZorroFi Update

- Posts

- The Lending Brief - December 16

The Lending Brief - December 16

Welcome to The Lending Brief,

Financial institutions aren’t debating whether to use AI anymore - they’re deploying it.

McKinsey says AI is already in production across banks. PayPal just applied for a U.S. bank charter to expand SMB lending efficiency. And FSOC is now explicitly tracking how AI adoption changes systemic risk.

And yet: most frontline workflows still feel the same. Files bounce. Teams re-ask questions. The hidden reason? AI doesn't fail at underwriting. It fails at intake.

Here are three signals from this week that all point to validation at intake as the leverage point most institutions overlook.

AI adoption is high - but value isn’t

🔍 What’s going on:

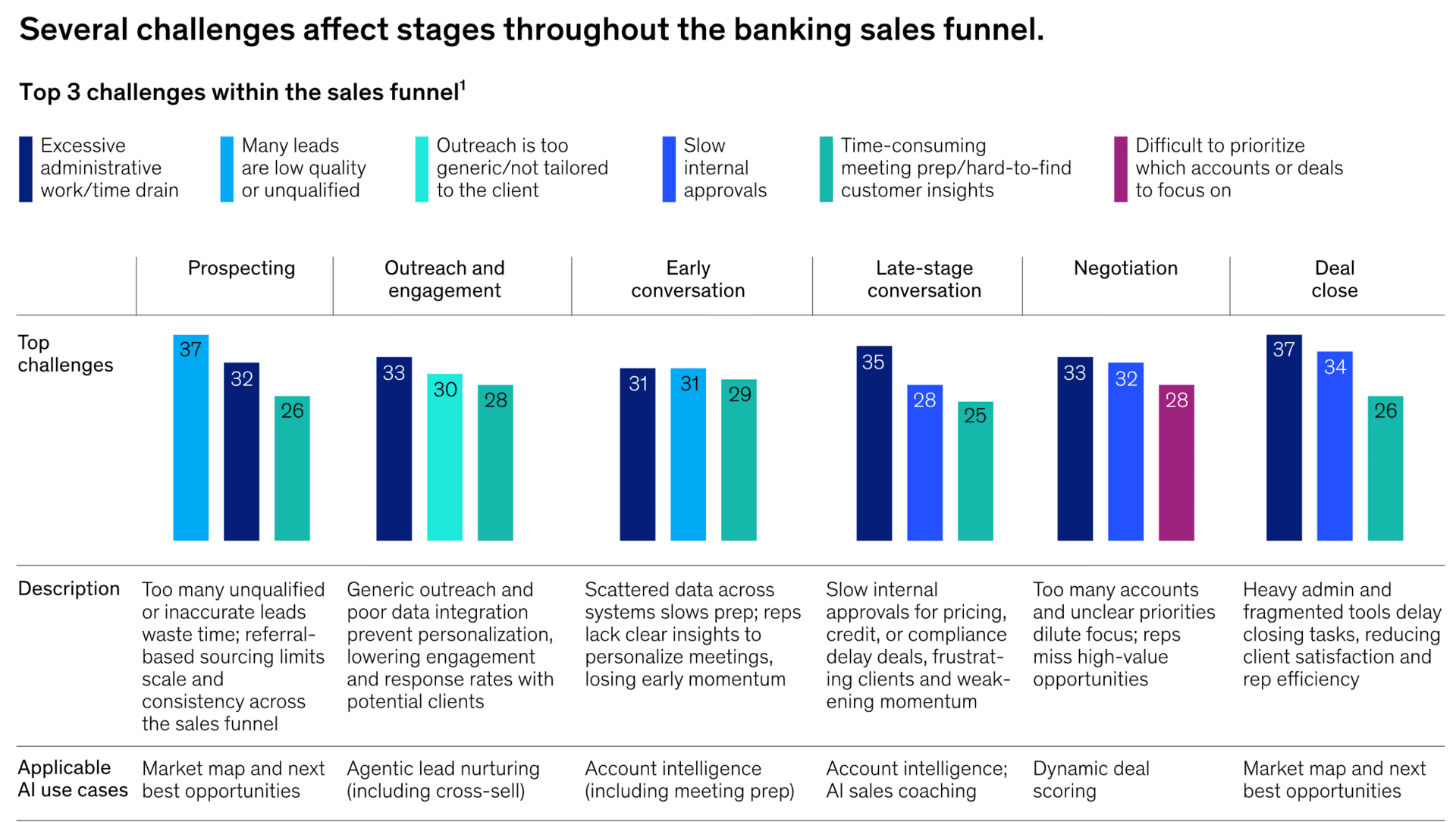

Banks are moving fast on “safe” AI use cases (summaries, search, notes) - while high-impact workflows (frontline lending, onboarding, compliance execution) remain stubborn.

McKinsey, “Agentic AI is here. Is your bank’s frontline ready?” (Oct 2025)

💡 Why it Matters

AI doesn’t create value just because it exists. It creates value when it’s attached to workflows that can actually move. If the file is incomplete, inconsistent, or unclear, AI accelerates the back-and-forth - not the decision.

⚡ Action steps

Pick one commercial product flow and mark where a file becomes “decision-ready.” Is it at intake - or three emails later?

Track one metric for 7 days: avg. number of borrower follow-ups per file (emails/calls/messages).

Label each follow-up: missing doc, conflicting doc, unclear ownership, or “other.” Your top category is your ROI choke point.

Fraud is now a trust leak

🔍 What’s going on:

New fraud data shows losses rising and a big share of scam victims don’t report incidents to their bank. Even when the institution could intervene, it often doesn’t get the signal early enough.

💡 Why it Matters

Fraud isn’t just a loss event. It’s a trust event - and increasingly, an intake failure.

When scams go unreported, institutions lose critical context: how the relationship started, what triggered urgency, why behavior suddenly changed. That missing context never enters the system.

In AI-driven workflows, this is especially dangerous. Silent fraud becomes an intake blind spot the system never learns from - and automation only scales what it’s given.

The result: faster workflows built on incomplete signals.

⚡ Action Step:

Add one simple intake checkpoint: “How did you hear about us / why now?” (it’s a lightweight scam-signal surface).

Create a “fast path” for uncertainty: one place borrowers can ask questions instead of splintering into email threads.

Review your last 10 “messy files.” Ask: Which mess would a fraudster exploit first? (inconsistent names, ownership gaps, swapped PDFs).

Regulators are shifting to operational resilience

🔍 What’s going on:

FSOC’s latest report makes it clear: the risk lens is widening beyond credit cycles toward cyber, operational resilience, and third-party dependencies - and it explicitly calls out that AI adoption is accelerating.

Meanwhile, the warning from lawmakers is simple: “the model did it” won’t be an acceptable explanation.

💡 Why it matters:

As AI touches more workflows, the standard rises for:

auditability (who did what, when, based on what)

governance (what’s automated vs. reviewed)

resilience (what breaks when a third party or process fails)

⚡ Action Step:

Do a quick “examiner test” on one file: Could you reconstruct the story in 10 minutes - what was collected, what was verified, what changed, and why?

Identify your top 3 third-party dependencies in onboarding/lending and add one question: What happens if this vendor is unavailable for 24 hours?

Decide (and document) one boundary: what AI can recommend vs. what humans must decide.

🦊 ZorroFi insight

AI value doesn’t start in underwriting - it starts when information enters the institution. ZorroFi validates and reconciles borrower inputs at intake (documents, entity details, inconsistencies) and creates a clean, time-stamped trail teams can trust - so speed scales without eroding relationship judgment.

💡 Want to Dive Deeper?

Demo: I work with CDFIs, community banks, and credit unions on modernizing lending. Want to learn more?

Subscribe: Get the full breakdown every Thursday in my LinkedIn newsletter -Lending Insights.

| Warmly, |